How To Change Bitcoin To Cash

Turn Your Bitcoin into Physical Cash with LocalBitcoins.com For those of you looking to trade your Bitcoin directly for physical cash, LocalBitcoins.com may be a better solution. LocalBitcoins is a person to person trading site where people can post their own bids for the buying and selling of Bitcoins to USD or other local fiat currencies. So, bitcoin to cash is a technique that is used to convert bitcoin to fiat cash. It means that by using this process, you can exchange cryptocurrency to your national currency. If you belong from united states and want to exchange Bitcoin to USD, you can do it by using this technique. Digital Currencies and Fiats. Several well-known exchange companies can convert your Bitcoin in.

How To Change Bitcoin To Cash On Cash App

If you own bitcoin or some other form of digital currency, there are many things you can do with it. Except for trading it, gambling with it, buying and selling stuff, or simply making more, one can also transfer cryptocurrency into traditional cash. Bitcoin (BTC) has been among us for more than a decade, so the industry has caught up nicely and everyone is accustomed to it. There are several options for converting your bitcoin into cash, and in this article, we will go over them. If you still want to learn more about the topic, make sure to visit cfds-trader.com where you can expand your knowledge and educate yourself on CFD trading.

1. Transferring Bitcoin to a Bank Account

Ever since it gained prominence, bitcoin is thought of as a currency that is eventually going to replace fiat currencies, which is another name for traditional, government currencies like US dollars and Euros. This is why a rising amount of people are investing in bitcoin and making money with it. However, until it completely replaces fiat currencies, there is still a need for cash, and those who have bitcoin sometimes need to convert. Still, more businesses do not accept digital currencies than those who have made it a legitimate paying option. Because of this, some customers are transferring their bitcoins to their bank accounts. This can be performed quite easily. Navigate your way to an online cryptocurrency exchange. Once you are there, create an account, sign in, verify everything, and sell however much you want. Then, transfer the money you get from your bitcoins into your bank account and withdraw it as you would normally, on an ATM, or a service like PayPal.

2. Get Cash through a Bitcoin ATM

Source: qz.com

Although they were quite scarce and not at all common during the last five or six years, more and more bitcoin ATMs are now available worldwide. Most major cities and economic centers around the world house modern, easy-to-use ATMs that can give you cash for your digital currency. This is also a relatively fast and easy way to convert bitcoin and other cryptocurrencies into government currency, most notably $, €, £, and ¥. Many of these devices let the users buy bitcoin too, in the same way you would deposit your cash at a normal ATM. Except for bitcoin, most cryptocurrency ATMs support Ethereum and Litecoin too, as well as other prominent ones. Keep in mind there are transaction fees that are still quite high, considering this is new technology. Fees tend to be much higher than regular fees of online banking. Conversation rates are another potential problem, so make sure to do some research first.

3. Bitcoin Debit Cards

Cryptocurrency debit cards are both an affordable and practical way of spending bitcoin and other currencies like it. They allow the users to deposit them on websites that can convert digital currencies into fiat currencies, again, most notably USD and EUR. VISA or Mastercard power each card, which can be associated with Monaco, CoinJar, BCCPay, Bitpay, and other less popular card issuers. Online and offline shopping work equally well with these cards, but the availability varies, and so do the daily and monthly limits. Compare each card to find the best one for your respective circumstances.

Things to Remember

Source: nairametrics.com

Before you decide to convert your hard-earned BTC into regular fiat currencies, we highly advise you to consider the following:

- Taxes

The popular saying goes, “only death and taxes are inevitable”, and the same goes for bitcoin conversion. There is still a high need for many jurisdictions that would clarify the position of bitcoin, including tax laws and other accompanying issues. Until that happens and things become clearer, most governments and tax authorities claim that the users have to pay taxes on profits they make when they sell their bitcoin for traditional cash. For those who think they can simply ignore these rules, it is not so easy. Some bitcoin exchange services have to report your profits to the tax people above them whenever you cash out, meaning you cannot hide forever.

- Fees

All three forms of converting bitcoin for fiat currencies listed above come equipped with heavy fees, higher than all the banking and online payment fees an average user is familiar with. An exception to this is only selling digital currency directly to your friends since you will probably not take advantage of one another and keep things civilized. In any other case, the exchange, BTC ATMs, and debit cards are going to act as intermediates, charging fees, and slowly poke and drain away from your digital currency.

Closing Remarks

It is relatively a straightforward process to convert your bitcoins to cash. The real question is whether or not you should do it. Cryptocurrencies are thought of as more of an investment than a traditional currency, which is why many advise against conversion. It is not the same as converting British pounds into American dollars. These people view it as selling property, land, or art, something that gains, or loses value over time. This is why it would be smarter if you kept it for the time being unless there is an extreme emergency. By doing so, you could earn a fortune in the coming years, considering the infamous spikes in wealth cryptocurrencies are known to have.

If you still wish to convert bitcoin into cash, take one more break, and consider the cost and ease of method you chose. Before you cash out, ask yourself do you really need the cash or you simply want to have your savings in the form of traditional money. Think of where it will be deposited, the type of currency and the country you live in, the conversion rate, and how long you can or want to wait to get cash. If you end up thinking it is not worth it, that is fine, because bitcoin is the future and it might be best to just save up your amount instead of converting it!

Cryptocurrencies have been around for a while, now, and more and more online businesses are beginning to accept bitcoin payments as legitimate direct payments. However, it can still be a challenging task to use your coins for every transaction you’ve to make. Whereas people do not indulge in frequent conversions from bitcoin to cash, because it costs a lot in fees that you’ve to pay as well as exchange rates make it tedious and unfavorable, conversions into cash from time to time are a great option people do indulge in. And, as mentioned previously, not all transactions allow you to pay directly in bitcoins. So, it might be a good option to convert Bitcoin to cash and simplify the process for yourself and the ones around.

So, if you are wondering how you will go about converting your bitcoin to cash, here’s some easy ways using which you can turn bitcoin to the actual money:

Use a Bitcoin ATM

Go to a Bitcoin ATM and cash your bitcoin earnings. Bitcoin ATMs, as the name suggests, are ATMs that turn your bitcoins to government-issued currency. Most major cities around the globe have Bitcoin ATMs for you to cash your bitcoins. This is usually the fastest away to cash your earnings.

You can also purchase bitcoins here in a regular way, and it works very similar to a regular currency ATM, so you should not be worried about how it works and all other functionality questions. Other than bitcoin, most other ATMs also accept Litecoin and Ethereum, too. One downside to this fastest way of bitcoin conversion to cash is the return rates are not exactly favorable to most of us, and the fees that you’ve to pay for these ATM transactions are way higher than online transactions. Hence, people choose online websites like https://bitcoinfuture.app that not only invest, trade, and mine their bitcoins but also retrieves them as and whenever they need them with much-needed flexibility and easier viability, under all circumstances.

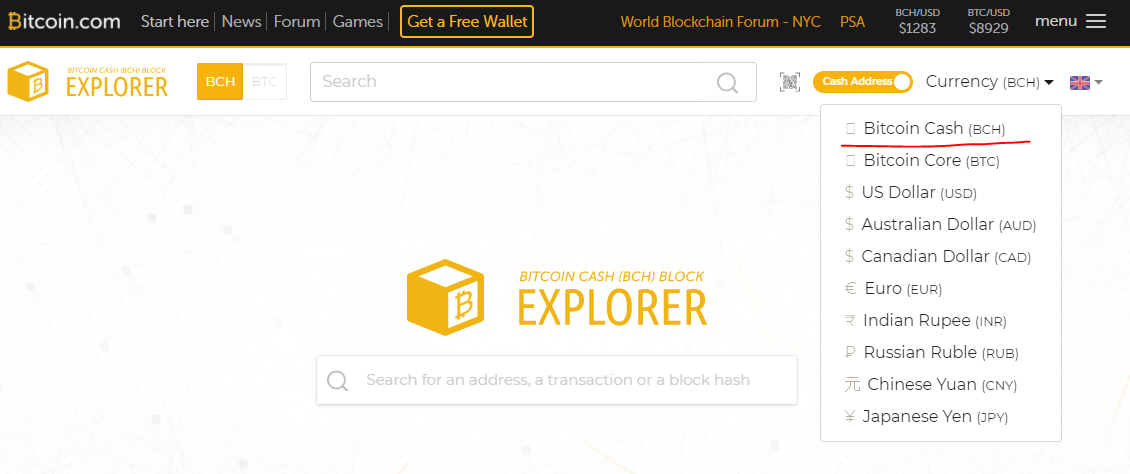

Use an Online Service

Talks about online services bring us directly to the option of online services, that you can use, to convert bitcoin to cash. Online services, that are reliable and professional, exist in multitude so that you can not only purchase cryptocurrencies and bitcoins online and track them but also you can sell these bitcoins to others, in exchange for the government-issued currency in your country. You can use their websites, and their Android or IOS applications and the tariffs on such transactions are way lower than Bitcoin ATMs and rates of exchange are also favorable. One of the most popular online services is https://bitcoinfuture.app/, where they connect to your bank account, for paying for your cryptocurrency and bitcoin purchases and returns.

When you sell your bitcoins, your earnings get converted and then transferred to your bank account securely, in a couple of days. Most people use these online services to cash out the profits of their bitcoins, through bank transfers, as and when viable to them. You can also your accounts to receive bitcoin payments from friends, family and customers.

Bitcoin Debit Cards

Ever heard of a Bitcoin Debit Card? Like normal debit cards, bitcoin debit cards, exist too. Their usage is very practical, as you can use these debit cards to pay for any cryptocurrency or bitcoin. They are also one of the most affordable ways to cash your bitcoin earnings because you can use these cards to pay any retailer of their choice. How these bitcoin debit cards work is through online services, where you deposit your cryptocurrency or bitcoin through an online service provider, which converts the bitcoins into fiat currency for you, like the US dollar or Euro.

Numerous bitcoin debit card providers exist, the best ones among them include CoinJar, Monaco and Bitpay. All these cards that are issued, are either powered by Mastercard, or Visa, that makes them eligible for all online and offline shopping purposes, and at offline retail shops too. Depending on your geographical location, it is determined whether you get access to a Bitcoin Debit card or not, and if you do, what are the daily and monthly permissible usage limits. So, before you get one, do your research well, and get a suitable card for yourself, depending on your country’s regulations and your geographical usage permits.

Send Money To Bitcoin Wallet

It is advisable that you keep your cryptocurrency or bitcoin earnings saved in an online service repository or digital wallet, and you can convert them into cash, after a considerable period of time. If a situation arises where you need to immediate finances, you can retrieve your bitcoin earnings via a debit card, or a Bitcoin ATM or convert it through an online service and transfer it into your bank account. If none of these work immediately, or you don’t have the necessary access, you can try selling them to your friends in exchange for fiat currency, or cash, as we call it.